Dec. 4, 2023

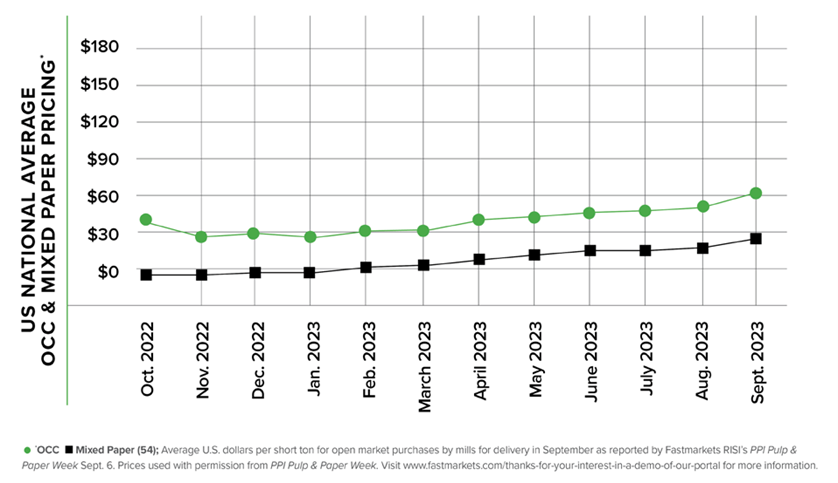

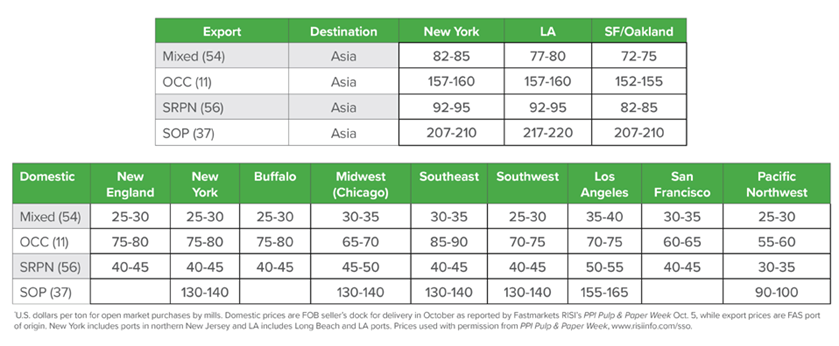

Last year's recovered corrugated and waste paper market prices could be moving out of their slump as the markets show glimmers of change. According to Fastmarkets’ PPI Pulp & Paper Week’s recent pricing survey and market report, Old Corrugated Container (OCC) prices rose in several U.S. regions this year, with a year-to-date average now at $54, up 86 percent or $25/ton since January. In addition, the market pricing run-up for U.S. OCC continued into November 2023 as pulp and paper mills took in tons to ensure enough raw material inventories through the Thanksgiving holiday.

For the last eight months, domestic OCC prices increased by $5/ton (FOB) seller’s dock in every region except for the West Coast. The national average for OCC now sits at $75/ton FOB at the seller’s dock, up from $33/ton in March. That’s welcome news, even though the high prices of 2021 and early 2022 have not returned. But are seven or eight straight months of small increases creating solid optimism in the recovered paper marketplace?

Not necessarily. While demand for U.S. OCC is on a bit of an upswing, there are still a myriad of issues and economic hindrances in the industrial recycling market. Mid America Paper Recycling’s Chief Executive Officer, Don Gaines, considers the current recycling market still fluctuating and unsettled. Demand for finished products has decreased due to consumers adjusting their spending habits. The export market continues to remain soft.

Gaines says he hasn’t heard anything from customers in the paper business that gives him any solid indications of an inflection point yet. “Where is the overall market today and where do we see things going? That's the million-dollar question.” He points out. “The recycling market this fall is still creeping along. The market will likely continue this way into next year. We talk with a lot of the pulp and paper mill buyers and hear that the paper markets are just kind of getting by, kind of waffling a bit. Some of the biggest paper mills are saying they see flatness in the market.

Slower production

Many mills in the U.S. had market-related downtime this summer, along with scheduled maintenance outages. Overall, U.S. industrial production, which includes production at pulp and paper mills, fell in October. This time last year, OCC orders and pricing were in their considerable decline. The recovered bulk-grade prices plummeted in August 2022, both domestically and in export markets. Recent reports indicate an uptick in recovered paper generation in the last weeks of October and early November 2023 ̶ the first notable increase in supplies all year. This comes as U.S. corrugated box shipments increased somewhat during the second and third quarters of 2023, compared with the first quarter’s slow pace.

So, Gaines is cautiously optimistic about the current commodities market. “We don't really see a lot of immediate growth,” he points out. “In the near term, we’re closing in on the holiday season, which, for the consumer markets, is often a better time of year. But this waffling back and forth is the reality right now.”

Slower scrap generation is part of the picture causing increased pricing according to Pulp & Paper Week. Many mills will take downtime or slow down for the holidays, and though they aren’t experiencing the tremendous drop they suffered in 2022, “the market still seems to be a bit weak and could easily continue through the first quarter of 2024,” Gaines adds. “But we also hear that if the mills can get through the first quarter of 2024, they'll be in a much better position. Right now, the crystal ball is not clear.”

Granted, he says, since the beginning of 2023 through October and in certain areas through November, scrap paper and corrugated pricing doubled and gained a lot of strength, “which is great, but it’s not where we all would like it to be. Remember, the market for these waste materials started the year at a low number. Now, the recycling world might need to either pull back or at least take a breath of air. Maybe it's retracting a little before it surges again next year. That’s the hope, but the crystal ball isn’t providing a definitive answer just yet.”

Like last year, the current corrugated and paper waste markets remain difficult to predict due to ongoing fundamental stresses at the mills, printing, and paperboard converting companies, and points along the supply chain. Higher fuel prices, significant inflation, and fewer e-commerce home deliveries to consumers caused by an uncertain economy are also contributing factors.

Glimmers of improvement

Despite the uncertainty, many of the numbers continue to move in the right direction, albeit slowly. The overall macroeconomic market trend statistics show signs of improvement. “We are working closely with the paper mills as much as we can,” Gaines says. “So, there’s good reason to be hopeful.”

Coping despite the market turbulence, Mid America Paper Recycling itself has experienced some bright spots amid the storm. “We have been aggressive in terms of finding new leads and sales,” Gaines notes. “We are also maximizing our marketing efforts, developing new projects and products to offer. We are always pushing forward and have steadily grown our recycling business. Even though the market imploded last year by over 81 percent, we saw our transaction volumes, and tonnage actually go up. Things continue to change, but we continue to value our people and attract and retain quality talent. There are some really talented people out there to be found and we recently found some of them. That’s a big reason we’re so successful.”

There are other positives, such as the upcoming capacity startups on sellers’ radars, including Pratt Industries’ new facility in Henderson, KY and Total Fiber Recovery in Chesapeake, VA. Both above mill owners expect their mills to consume OCC and Mixed Paper from recycling facilities.

Education, Support Waste Audit Assistance

Will there be a soft landing if inflation numbers cool and federal interest rates stay where they are? Major containerboard and paper and board mills reported production rates at mid-80 percent, for the second quarter in a row. Company leaders in recent earnings calls touted a better start to their runnability and an increase in bookings for orders. Going forward, do these factors translate into some positive benefits for recyclers of paperboard, corrugated, and plastics?

“This sounds good,” Gaines says. “I would say the trucking world, which was booming for several years, is now severely challenged and as the freight market has retreated so has freight rates. The decreases have some benefits in the recycling world. We are very much freight-driven, where we are picking up and moving loads from one place to another, so that's good news for sure. The freight pendulum is beginning to swing slowly back. There’s a bit of calming out there.”

Gaines adds that Mid America Paper Recycling always helps to educate customers on effective recycling methods and supports them during the highs and lows of these market pressures. “It’s part of our mission to share our recycling industry knowledge and expertise on how to best handle material, how to best bale material, and how to best ship material. We are watching the markets closely and regularly and help our partners prepare for the changes taking place. Everyone reads the tea leaves differently, so we want to be there for our partners despite the fluctuations, and continuously innovate. We want to implement new techniques that allow us to recycle more material, generate more revenues for customers, and allow them to improve. There are many ways we can help our partners add value. A key to it all is through education.”

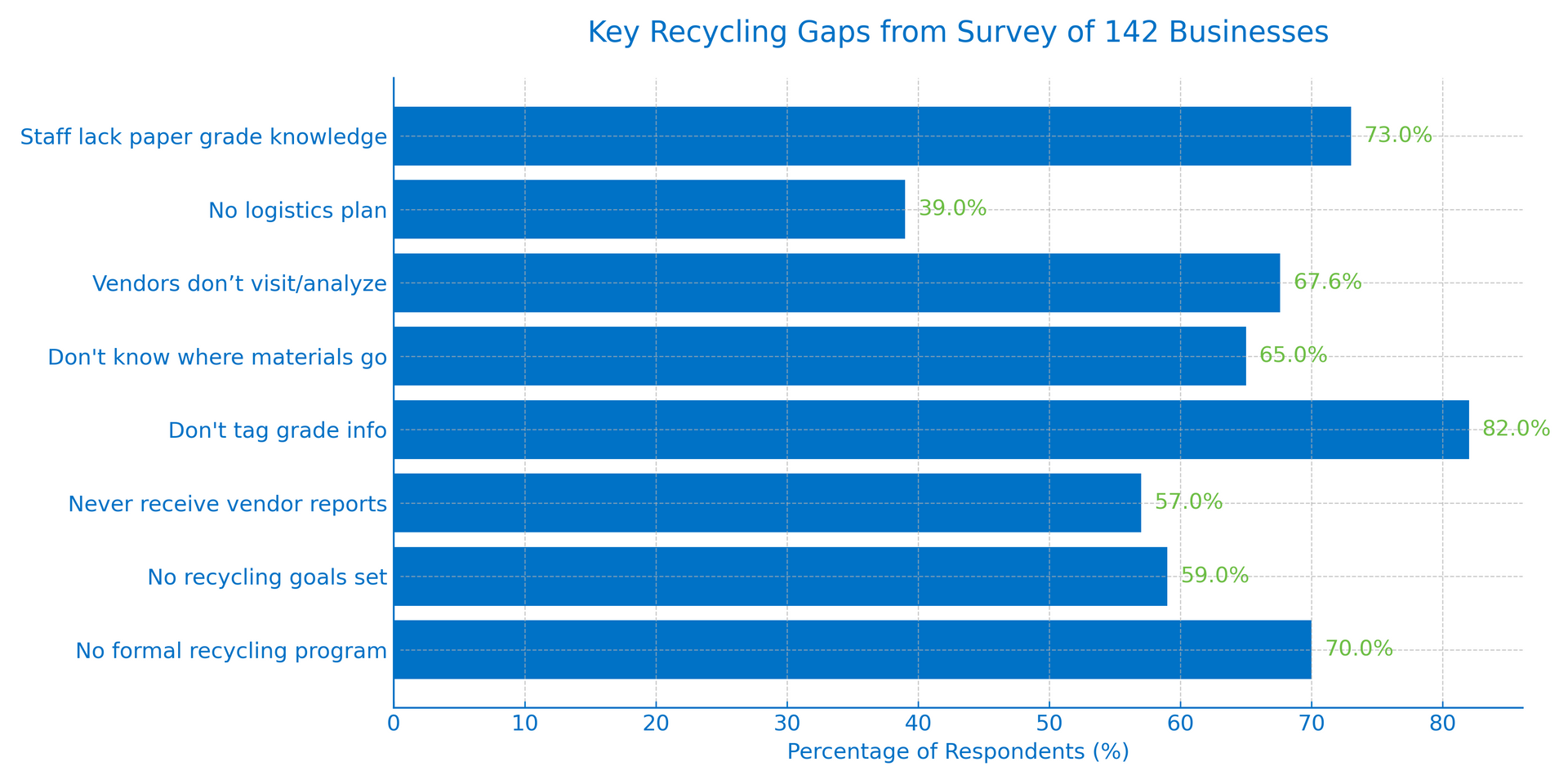

One way Gaines suggests to improve a recycling operation’s, waste collection processes, sorting, and more is to take Mid America Paper Recycling’s free, quick Waste Audit Survey. “Our Waste Audit Survey determines what our customers are starting with, what they can improve, and helps us find ways to help divert a lot of materials they might be throwing in landfills. The survey points to what is working well and what areas may need improvement. Sometimes, we can help them with equipment that can better do what they need to do, bale loads more productively, or help handle certain waste materials more efficiently. Our Waste Audit is a key benefit they can use to provide in-plant training initiatives and streamline processing and handling while avoiding costly dumpster fees.”

In these times, Gaines advises talking with Mid America Paper Recycling. “If the markets improve, there’s even more reason to work with us,” he says. “You can depend on us to serve you the right way.”

Take our free less-than10-minute Waste Audit Survey today. To learn more, or talk with us about any market concerns, visit www.midamericapaper.com and click on www.surveymonkey.com/r/MAPRAudit.